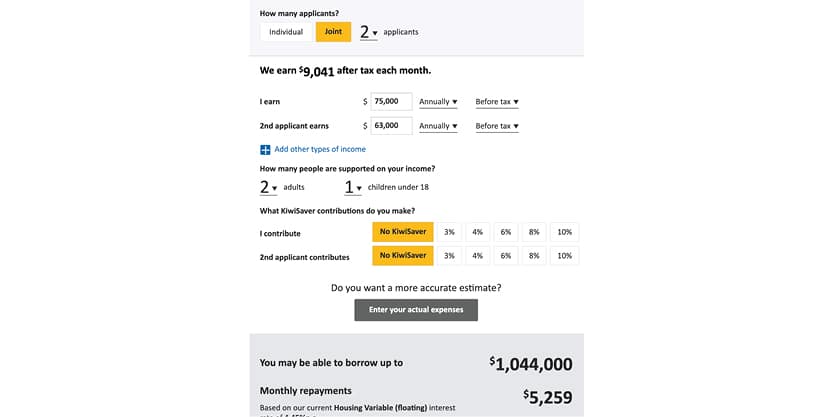

Borrowing power calculator

This reduces the D to C and lends 1 or 16 decimal to the first column. Your borrowing power is the amount a lender will let you borrow when you apply for a home loan.

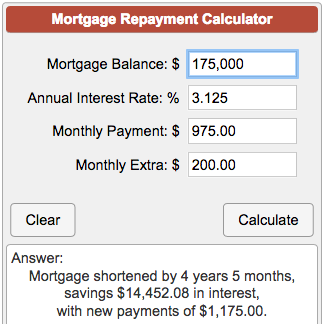

Loan Repayment Calculator

Log in Call Us 0800 500 123.

. Know your budget with a Mike Pero mortgage calculator. This calculator does not take into account specific factors used by. Whether you need a mortgage calculator to work out your borrowing power loan repayments or to find out what extra repayments will save you on your mortgage youll find them.

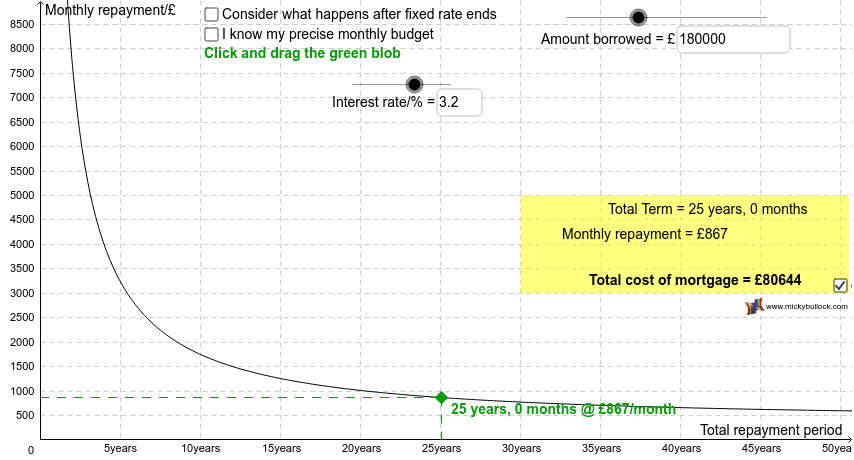

This is a handy step to take before you contact your mortgage broker so that you can see the effect different interest rates and loan periods will have on the amount of money you can borrow the total interest you pay and your estimated. Overall though you should probably approach borrowing against a whole life policy with caution. If you want a more accurate quote use our affordability calculator.

Also known as borrowing capacity it is one of the most important factors in determining what you can afford when it comes to buying a property. Use our buy now or save calculator to compare options. View your borrowing capacity and estimated home loan repayments.

The information in the calculator does not constitute an offer to lend or imply the product is suitable for you. For information on how these results are calculated details are listed on our borrowing power calculator assumptions page. Many loans accrue interest daily monthly interest charges may change depending on the number of days in a month.

Our home loan borrowing power calculator could help you work out what you may be able to afford to borrow from a financial institution based on your income and expenses. 16 decimal 12 decimal - 15 decimal 13 decimal or D in the first columnThe following columns require no borrowing making the calculations simple. The definition of a margin call is when an investor buys stock on margin and that stock decreases in value to a certain degree then the broker will issue a margin call to the investor to prompt them to either pony up.

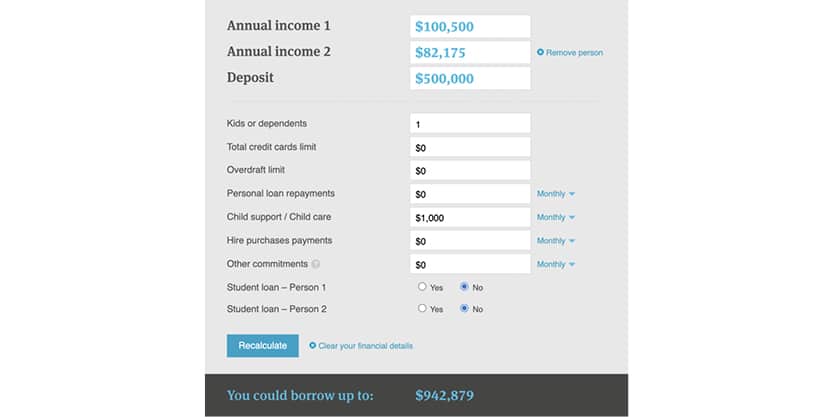

Speak to an expert. Our borrowing power calculator asks you to enter details including your loan term and interest rate income and expenses and any outstanding debts. This calculator doesnt take into.

Try our Borrowing Power Calculator and find out how much the banks will lend you for your home loan. Now that the NerdWallet How much can I borrow calculator has given you an idea of your buying power you may want to gut-check the number by. Your income expenses and deposit are the biggest factors determining your borrowing power but lenders also consider other factors such as your existing debts and if you are using a guarantor for the loan.

Looking for more insight from a borrowing power calculator. The amount you may be able to borrow is determined by your financial situation. The Average Earnings are a good way to determine the relative cost of something in terms of the amount of work done by the average worker that it would take to produce or the relative time spent at work by that worker in order to earn its cost.

Our borrowing power calculator gives you an initial estimate of what a lender may be willing to lend to you. Home equity loan requirements. Estimate how much you can borrow for your home loan using our borrowing power calculator.

Please note that the values provided can only be taken as an estimate of the amount to be borrowed. Better choices might include a zero percentage credit card offer a home equity line of credit or an emergency fund. Accessed Aug 2 2022.

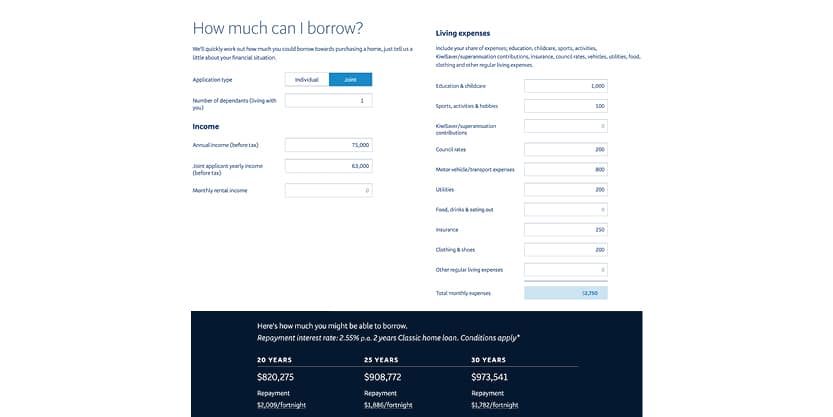

How much can I borrow. Just input your income and expenses and well do the rest. Calculate repayments Calculate repayments.

Find out how much you may be able to borrow and the potential costs involved in buying a home. Our buying power calculator gives you an idea of the maximum you could spend on a property in minutes. Call us on 1300 889 743 or complete our online enquiry form and we can let you know your borrowing power.

Estimate your borrowing power. We have assumed one year is 52 weeks or 26 fortnights. Our borrowing power calculator will estimate how much you could borrow and what your loan repayments will be so you can figure out if our ubank home loans suits you.

See how much you may need to pay back each week or month. Calculate borrowing power Calculate borrowing power. Small Commercial Insurance Study.

Earnings here represent an estimate of the total monetary value of the compensation an average worker in full time employment would. Alternately you can ditch the math and use our home equity loan calculator. Should you pay Lenders Mortgage Insurance buy a home now or save for a bigger deposit.

Get a quick quote for how much you could borrow for a property youll live in based on your financial situation. Are the tax scales current. Our buying power calculator helps you estimate your maximum property purchase price.

ImportantThe estimated amount you could potentially borrow is a guide only. In the first column on the right of the above example C or 12 decimal is smaller than F or 15 decimalAs such it is necessary to borrow from the next column. Personal loan borrowing power calculator.

Run affordability scenarios. The information provided by this borrowing power calculator should be treated as a guide only and not be relied on as a true indication of a quote or pre-qualification for any home loan product. How to calculate your borrowing power for a home loan.

The easy to use online Margin Call Calculator makes it easy to learn how to calculate margin calls for your portfolio with just a few key presses. Buy Now Or Save More Calculator. Youll need to spend a little longer on this.

This therefore assumes a year has 364 days not 365 or 366. We regularly update the calculator with current tax scales to make sure that the tax payable is correct for differing income brackets. Try our mortgage calculator today and discover your borrowing power.

Home loan repayment calculator. This is largely made up of your income your financial commitments current savings and your credit history. Youll also need to consider your spending habits and any existing commitments such as personal or car loans.

I wouldnt rule it out but it wouldnt be my first choice financial advisor Mendels says.

Loan Repayment Calculator Direct Credit Home Loan Specialists Australiadirect Credit

Mortgage Calculator To Discover Your Home Loan Options Instantly Online

Loan Repayment Calculator

Mortgage Calculator To Discover Your Home Loan Options Instantly Online

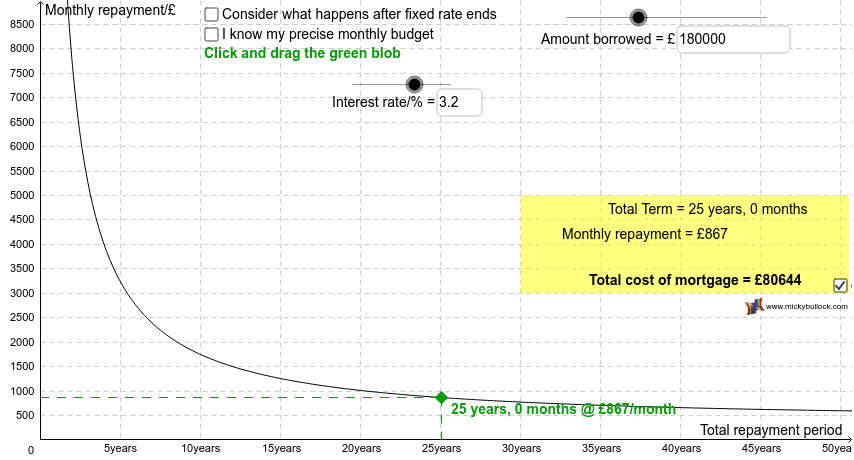

Graphical Mortgage Repayment Calculator Geogebra

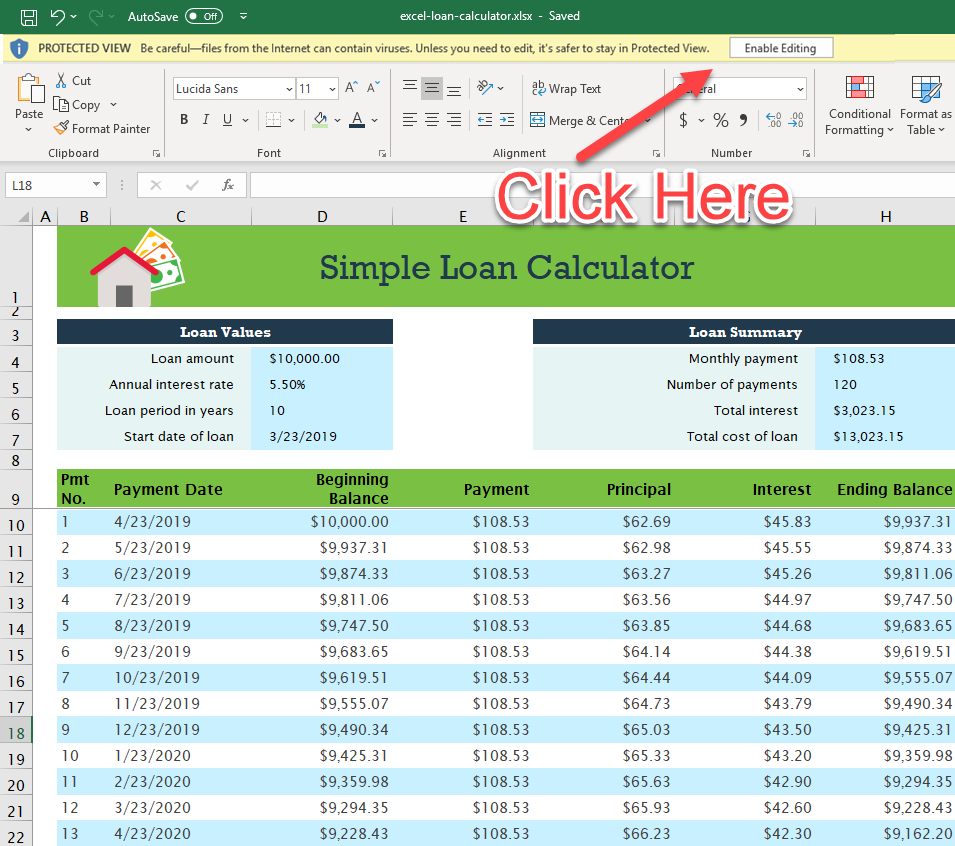

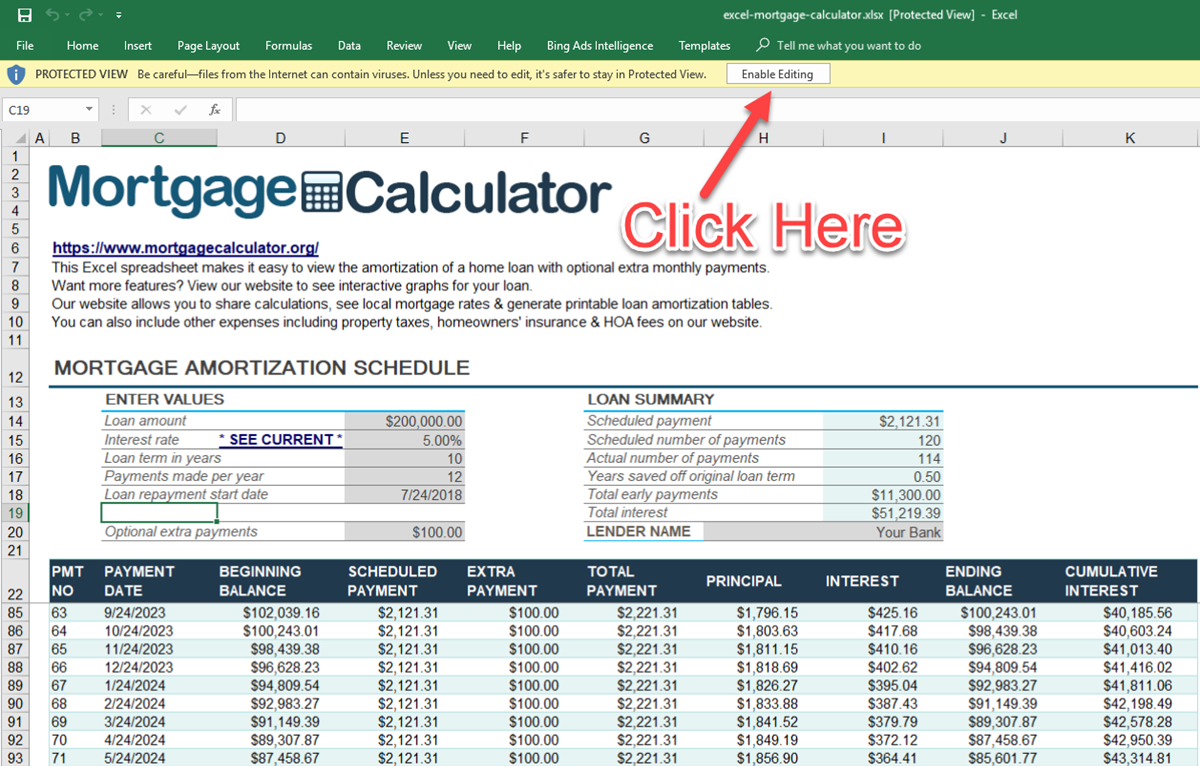

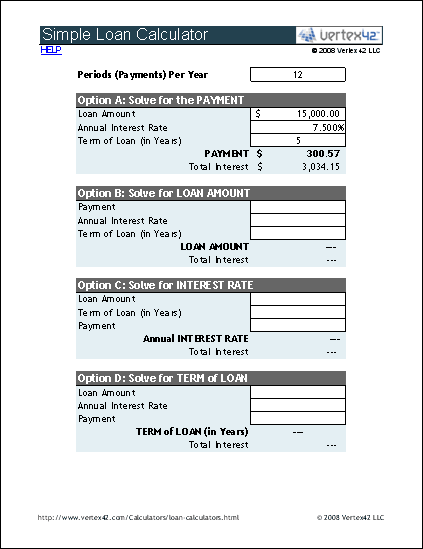

Download Microsoft Excel Simple Loan Calculator Spreadsheet Xlsx Excel Basic Loan Amortization Schedule Template

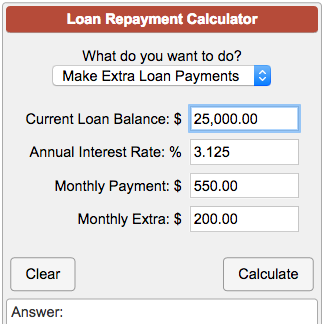

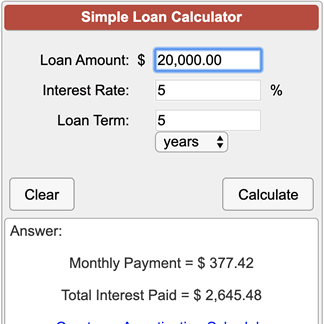

Loan Repayment Calculator Personal Loans Mortgages Repayments Disabled World

Simple Loan Calculator

Mortgage Calculator To Discover Your Home Loan Options Instantly Online

Mortgage Repayment Calculator

Download Microsoft Excel Mortgage Calculator Spreadsheet Xlsx Excel Loan Amortization Schedule Template With Extra Payments

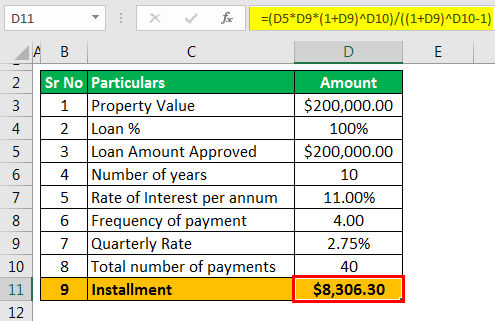

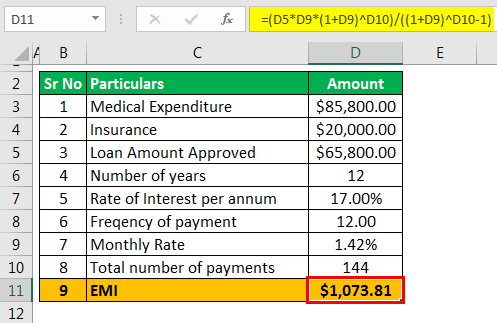

Loan Repayment Calculator Step By Step Guide With Examples

Loan Calculator Free Simple Loan Calculator For Excel

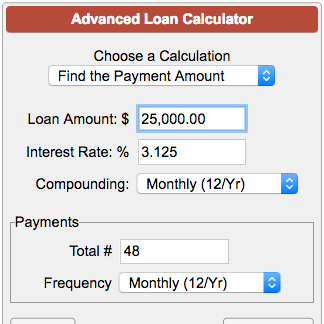

Advanced Loan Calculator

Loan Amortization Calculator

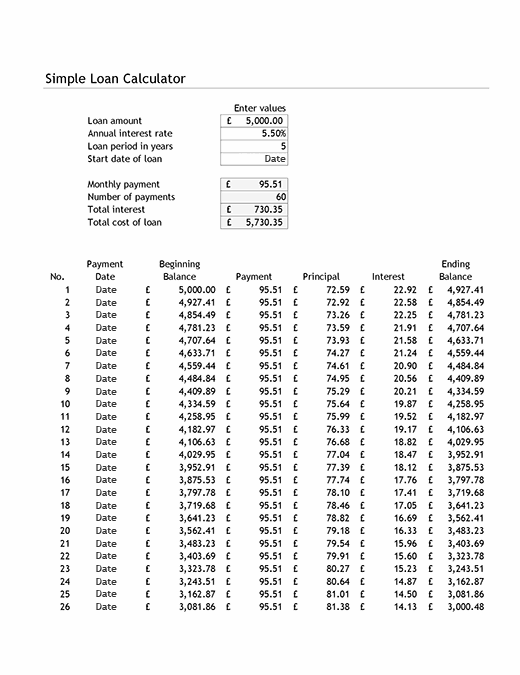

Simple Loan Calculator And Amortisation Table

Loan Repayment Calculator Step By Step Guide With Examples